I know. You hate credit card debt. I hate credit card debt too. That’s why I kicked credit card debt to the curb a long time ago! But you may be looking at your situation with a sense of hopelessness. Maybe you’re telling yourself that you will never get this paid off. I understand that feeling and I want to tell you that it doesn’t have to be that way! There is a solution to your debt problem!

I know. You hate credit card debt. I hate credit card debt too. That’s why I kicked credit card debt to the curb a long time ago! But you may be looking at your situation with a sense of hopelessness. Maybe you’re telling yourself that you will never get this paid off. I understand that feeling and I want to tell you that it doesn’t have to be that way! There is a solution to your debt problem!

Your secret weapon is the debt snowball.

The debt snowball method is all about tackling debt with a focus on the smallest balances first. This strategy shifts the spotlight from numbers to motivation, which can be a game-changer for many of us trying to dig ourselves out of debt. It’s easier to keep going when you’re winning little battles along the way.

One of the main reasons the debt snowball method works for so many people is the psychological boost it offers. As debts disappear, no matter how small, they create a sense of accomplishment. This feeling can fuel motivation, encouraging a continued commitment to paying off debts. It turns out, being able to see quick wins can be just as important as managing interest rates and balances.

The method became popular thanks to Dave Ramsey, a financial guru who has been teaching the debt snowball approach for over thirty years. He argues that conquering the psychological hurdles of debt repayment is often more crucial than simply focusing on the interest rates. By concentrating on paying off the smallest debt first, you can build confidence and positive momentum.

This method might seem counterintuitive since it doesn’t directly address interest rates first, but there’s real power in the emotional payoff. The confidence you build from taking control over your financial situation can lead to better habits and stronger financial health overall. This approach isn’t just about numbers; it’s about building a mindset that fights debt sustainably.

How to Implement the Debt Snowball Method: Step-by-Step Guide

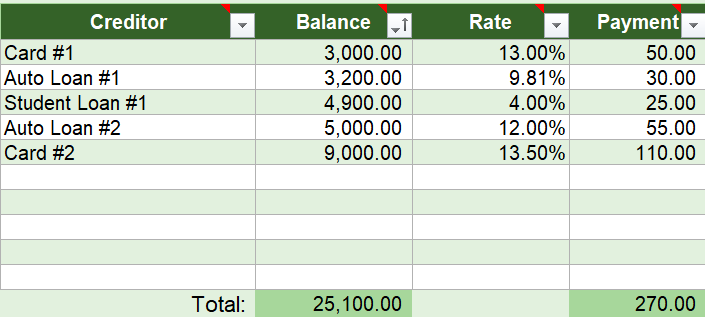

Start your journey to slaying debt by first taking a complete inventory of any debts. This means listing out every single balance, no matter how small, and organizing them in order of size, starting with the lowest. This initial step is crucial as it sets the stage for the snowball to start rolling.

Next, it’s time to rearrange those debts in front of you and get your mindset right. You’ll be attacking the smallest debt with any extra funds you can scrape together. This could come from cutting down on unnecessary expenses, selling unused items, or finding small side gigs.

Next, it’s time to rearrange those debts in front of you and get your mindset right. You’ll be attacking the smallest debt with any extra funds you can scrape together. This could come from cutting down on unnecessary expenses, selling unused items, or finding small side gigs.

Once your debts are lined up, take that extra cash and begin firing it at the smallest balance while maintaining minimum payments on all other debts. This selective focus accelerates the repayment of that small debt, providing you with the quick win needed to stay motivated.

To make this work smoothly, it may help to see an example. Let’s say you have three debts: $500 on a store card, $1000 on a credit card, and $5000 in student loans. Allocate any spare money over minimum payments to the $500 balance. Once that’s paid off, take its minimum payment and add it to the $1000 debt while continuing minimums on the student loans.

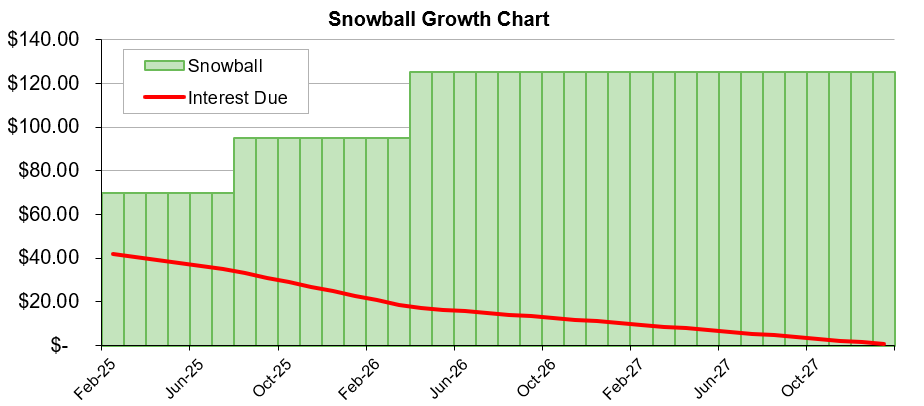

The green bars in the graph above show the growth of the debt snowball over time while the red line shows interest paid over time. The great news is the faster you get debts paid, the

The green bars in the graph above show the growth of the debt snowball over time while the red line shows interest paid over time. The great news is the faster you get debts paid, the

It’s not just about the action but also keeping an eye on your budget. You want to make sure that everything you can spare is going toward those debts. Using budgeting tools or apps to track expenses can help identify areas where you might save more for debt repayment. This aggressive focus can add up to major victories over time.

Incredible Results: Success Rates and Timeframes of the Snowball Method

Statistics have shown that people using the debt snowball method often succeed in reducing their debt faster than anticipated. One study found that individuals who adopted this approach were more likely to pay off all their debts compared to those who prioritized by interest rate. Seeing those small debts vanish creates a rewarding momentum.

On average, many who stick with the debt snowball method report achieving significant results within a year. Of course, the actual timeframe can vary based on individual circumstances like income and the initial amount of debt. However, the discipline built through small victories often accelerates the repayment process.

Real-life stories from those who used the debt snowball method provide a deeper understanding of its effectiveness. Many share that their financial behaviors changed for the better after experiencing the positive effects of eliminating smaller debts. These personal accounts highlight the powerful shift in mindset that comes with each cleared balance.

Aside from immediate debt reduction, the debt snowball method lays a foundation for long-term financial stability. Once debts are gone, the same principles of discipline and prioritized payments can be applied to savings, investments, or essential financial goals. The transition from paying off debts to building wealth becomes seamless and natural.

So kick credit card debt to the curb for good by building a solid budget and maintaining an aggressive consistency over time and you too can become debt free and start building serious wealth.